The best budgets are a realistic and accurate representation of your personal finances. That means you need to plan your budget around a reasonably complete picture of what you earn and where you spend your money. If you budget to spend $200 a month on groceries and you are much more likely to spend $300, your budget will never work no matter how hard you try. That’s where a 30-day spending journal comes in.

What is a spending journal?

A spending journal is a record you keep of every dollar you spend money on for a period of time. We recommend you spend at least a month exploring your past spending. The more history you have about where your money goes, the more accurate your budget projections will be.

The best spending journal includes every expenditure, even the little things like your morning coffee, app purchases, and other incidentals. Keeping a spending diary is about knowing where you spend money today so you can set achievable spending priorities for tomorrow. It is a critical step to be sure you create a budget that’s designed to succeed.

This is not an exercise in berating yourself about your current spending decisions. It’s not just about identifying needs vs wants. A spending journal gives you an improved awareness of your current spending habits when you’re left to your own devices.

Read more with Wealthing Like Rabbits author, Robert Brown’s take on why you need to create a spending summary.

How do you track your spending?

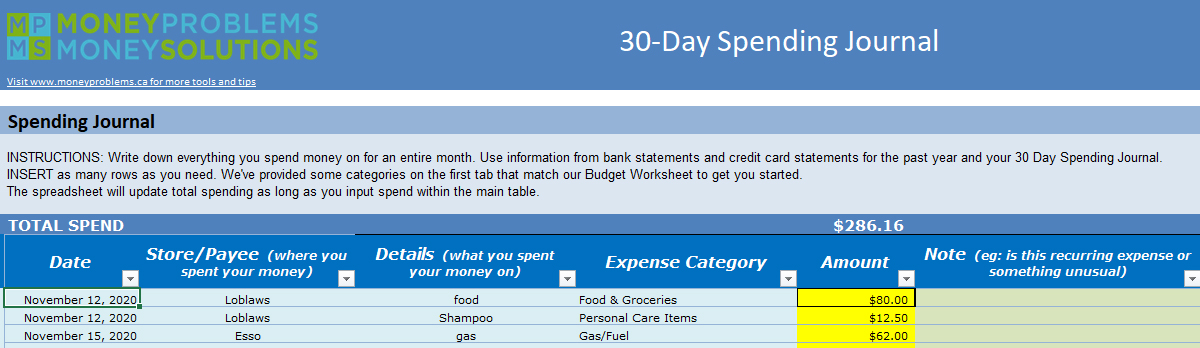

There’s no hard science to creating a 30-day spending journal. You can use any method you like, a notebook, phone app or download our Free Excel 30-Day Spending Journal.

If you are journaling with a piece of paper you want 4 basic columns:

- the date,

- the store or payee (where your money went),

- the expense category (what you purchased), and

- the amount.

It’s also good to add a fifth column for notes such as if this was an unusual expenditure like an unexpected repair bill or gift. You can write down whether you had second thoughts about that particular purchase. These notes will come in handy when you are looking for ways to reduce or manage your spending.

Best practices for creating a successful spending diary

The more detailed your tracking, the easier it will be for you to find areas to cut back and save. Often budgets fail simply because your projections were off, and your projections will be off if you don’t have the correct starting point.

Here are some best practices to follow:

- Meticulously record all cash, credit and debit purchases.

- Be detailed enough that you will be able to identify expenses you can do without versus necessities.

- Summarize where it makes sense (eg all food items you purchased in one trip as groceries).

- Pull out your statements for the bigger, more regular expenses. Look at your credit card statements, utility bills and bank statements for the past year. Here is where you will find out what you spend on your rent or mortgage, car payments, utilities, insurance, property taxes, and all your other living expenses.

- Including a record of any automated savings or bill payments, as you will need these to create your budget projections as well.

Keep a separate list of who you owe money too, your monthly debt payments and any automatic savings deductions as you will need these to create your budget projections as well.

Spend 30 days noting down your expenses in this way and you’ll gain an exhaustive – and accurate – overview from which to create your budget plan. You might be surprised to find out spending habits you didn’t know you had. And as the month progresses, you will probably also find that you begin questioning your purchases much more consciously.

It really helps to tell people that you are doing a 30-day spending plan – that way you’ll feel accountable to stick with it. You will probably feel like skipping a day or two during the process, and having someone who you know will be checking in with your progress can really help to keep you motivated.