It’s easy to get dejected if your credit score isn’t where you want it to be. But just because you have a low score today, it certainly doesn’t mean that you’re stuck with it for life. Even if you have faced a bankruptcy or consumer proposal, or have accounts in collections, there are measures you can take to improve your score. In this article, we run through everything you need to know about rebuilding your credit.

Understanding Credit Reporting

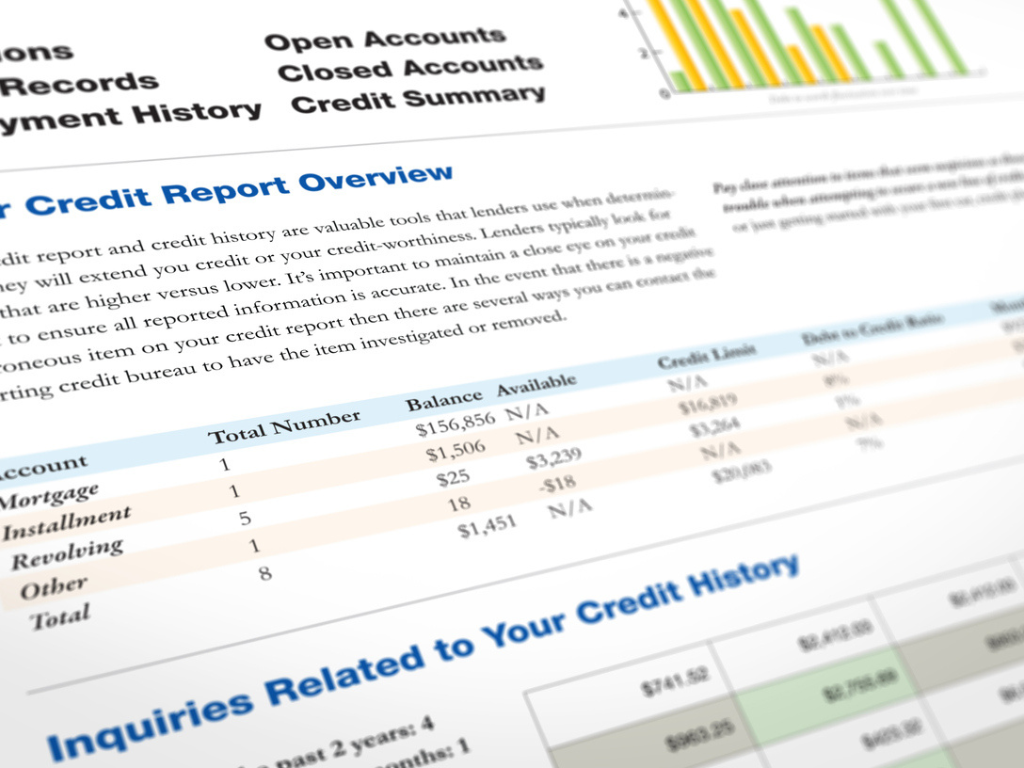

If you want to take control of your credit score, it’s important to understand exactly how the credit reporting system works. Knowing what is on your credit report, what can be removed and how lenders view your credit is an important step to knowing what to fix.

Your credit report is a complete overview of your history managing credit and debt. If you have ever had any kind of credit or loan, then you have a credit report. It will cover everything from how much debt you have, your repayment record, your employment history, where you live and whether you’ve had any recent bankruptcies, accounts in collections, repossessions or lawsuits filed against you. This information is used by lending companies to decide how trustworthy you are to lend to.

Canada has two credit bureaus – Equifax and TransUnion. Companies like Borrowell or Credit Karma are not credit bureaus. They get their information from one of the main credit bureaus and massage that information for their customers.

What Can Credit Repair Improve?

Credit repair cannot improve your credit score directly. What it does is rebuild a new, and better credit profile. The result of a better credit history leads to a higher credit score. This is why rebuilding credit takes time.

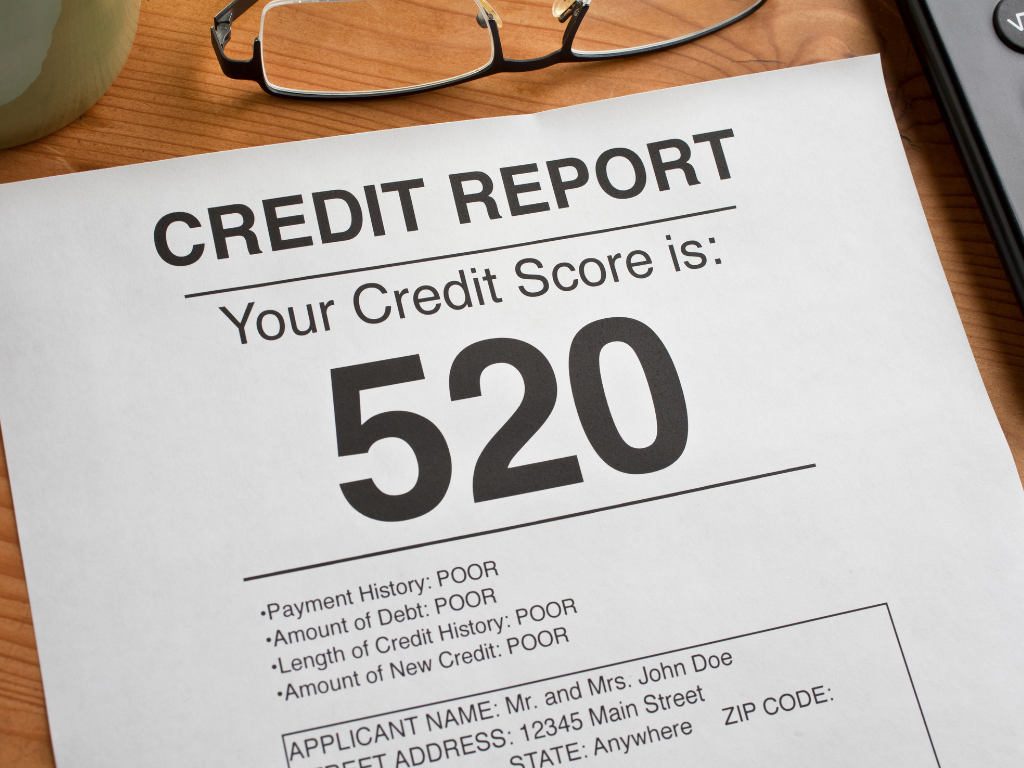

What affects your credit score?

Your credit score is a separate 3-digit number created by the credit reporting agencies. This score is a numerical representation of your creditworthiness and has an impact on both your ability to borrow and the interest rate you will be charged.

While no-one knows exactly what goes into this calculation, in general, these are the factors that affect your credit score:

- Payment history – whether you pay on time, late or are in default.

- Credit balances – how much you owe on each loan and in total

- Utilization rate – how much you owe today relative to how much credit you have available

- Types of credit – how many types of loans you have (credit cards, lines of credit, retail accounts, installment loans)

- How many loans you have – both too little credit and too many loans can hurt your credit score

- New loan applications – multiple hard inquiries for new credit can reduce your score

- Length of credit history – both the age of your oldest and newest account

These are the factors that you want to impact, in a positive way, when trying to build good credit and increase your credit score.

What credit repair can’t do

Credit repair can’t remove negative items from your credit report. Collection notices, bankruptcy, late payments reported to the credit bureaus remain for a specific period of time.

- Late payments remain on your report for up to 6 years.

- Collections or accounts written off are removed 6 years from the date of your last payment

- Hard inquiries remain on your credit report for 3 years

- Court judgments are removed after 6 years

- Credit counselling remains for 6 years after filing, or 2-3 years after completion depending on the credit bureau, whichever comes first.

- A consumer proposal is removed 6 years after filing, or 3 years after completion, whichever comes first.

- Bankruptcy remains on your report for 6 years after discharge.

The good news is that positive credit information (accounts paid on time) remain on your account for a period of 20 years. That means as these factors fall even, even old good accounts will once again help you rebuild your credit score.

Can a Credit Repair Company Actually Help?

Credit repair companies offer to rebuild your credit quickly by offering credit repair loans. The credit repair agencies report your payments to the credit bureau which they claim builds a new, positive, payment history on your credit report.

There are however negatives to working with a credit repair service:

- These loans can be quite costly, with fees that equate to an interest rate of 39% or more.

- So-called ‘savings loans’ are not actually a loan. You make contracted monthly payments but do not receive any money until the end of all your payments.

- Defaulting on the contract can have severe negative financial consequences.

To see an actual example visit https://www.hoyes.com/blog/credit-repair-loan-or-savings-loans-are-they-worth-it/

DIY Credit Repair. You Can Repair Credit On Your Own

Repairing credit on your own is possible, it’s not complicated and if often the fastest and cheapest way to rebuilding your credit.

Step 1: Eliminate burdensome debt balances

If you haven’t already addressed excessive debt, the very first step to rebuilding your credit is to eliminate debt. Having a lot of existing debt relative to your income will significantly impact how ‘credit-worthy’ lenders assess you to be, so your first step should be to reduce your credit balances.

Step 2: Review your current credit report

In order to know how to improve your credit profile, you first need to be totally clear on what your current credit report shows.

You can order a free copy of your credit report from Canada’s two leading credit bureaus, Equifax and TransUnion. For the sake of being thorough, we suggest ordering a report from both agencies as not all lenders report everything to both credit bureaus. If you use a free credit score company like Borrowell, Mogo or Credit Karma beware that what they report may not be what your lender sees.

Step 3: Correct any errors and mistakes

One of the most common issues leading to a low credit score is having mistakes on your credit profile. Negative information on your credit report will reflect in your credit score, which will, in turn, impact your chance of getting credit.

The most common kinds of mistakes to look out for are:

- Incorrect mailing addresses

- Wrong social security number

- Signs of identity theft (usually in the form of credit you didn’t apply for)

- Inaccurate notices about late payments

- Unauthorized credit inquiries

- Incorrect information about any bankruptcies, consumer proposals or debt management plans

Correcting errors on your report takes time and perseverance, but it is an important step to improve your credit rating.

Remember, you have the right to one free credit report from each bureau per year. If you suspect there might be issues you need to correct, then you could request your Equifax credit report now, and then follow up in six months with your TransUnion report to make sure the errors have been fixed.

Step 4: Start to rebuild your positive credit history

Though rebuilding a poor credit history takes time, it’s certainly not impossible. In fact, there are steps that you can actively take to evidence that you are a reliable and trustworthy person to lend to. These are:

Apply for a secured credit card

Start by getting a secured credit card. Lenders reduce the risk of giving you credit by asking for a deposit when you apply for the card, hence why it’s known as a secured card. By using the card regularly and paying your balance off in full each month, you’ll soon begin demonstrating that you are able to manage credit responsibly. This is a great option for those rebuilding after a bankruptcy or consumer proposal.

Keep utilization rates low

Since utilization rates affect your credit score, never use up to the full limit on your secured credit card, or any future revolving type credit. Keep your utilization rate below 30%. This means if you have a credit limit of $1,000 never borrow more than $300 on the card. Making frequent payments, rather than waiting for your statement due date to arrive, is a great way to manage your utilization rate.

Move onto a regular credit card

After around a year of positive credit management with your secured credit card, you should consider moving onto a regular unsecured card. Only do this if you know you can manage the debt you’ll incur responsibly – the last thing you want is to wind up further damaging your credit profile with late payments. Spend only what you need, and only get one card with a low limit to minimise the risk of you spending more than you can repay.

If you are turned down, don’t reapply for at least six months. Avoid too many hard inquiries as this will lower your score.

Make sure your cell phone provider reports your payments

Both Equifax and Transunion now list cell phone contract plans as a trade line on your credit report. Not all providers have a policy to report to the bureau however, so make sure your cell phone payments are appearing, and again, make sure to avoid any late or missed payments.

Increase variety with a term loan

After 6-12 months of positive credit management with a credit card, if your score has improved, you can try to apply for a short term loan. Only apply if you have a stable income that will indicate your ability to repay the loan, and only borrow what you need. If you go down this route, confirm with the lender that they will report it to the credit bureaus so that it will impact your credit score.

If you still have relatively bad credit, you can consider taking out a loan with a co-signer. However be aware that if you miss payments because you can’t afford the loan, your credit score will decline and your lender will demand payment from your cosigner.

Put money aside for a down payment

To maximize your chances of being approved for a large loan, start to set money aside for a bigger down payment. Not only will a larger down payment improve your chances of securing the credit you need, but having a lower loan balance relative to your income will positively affect your credit score.

Step 5: Keep your accounts healthy

By carrying out the steps above, you’ll show that you can not only obtain new credit, but also that you can use it wisely. Over time this will go a long way to improving your credit profile. However, and it is a big however, this will only be the case so long as you keep your accounts and any debt liabilities healthy. Some tips for doing this are:

- Always pay your bills on time. Set up automated payments to eliminate any risk that you could miss a payment

- Always pay more than the minimum repayment to keep your loan utilization rates below 30%.

- If you are denied credit, wait a while before re-applying to avoid the negative impact of multiple credit applications.

Credit Repair After Debt Relief

One of the biggest concerns expressed by people with high debt worry about debt relief programs is how they will affect their credit score.

Whether you declare bankruptcy, file a consumer proposal, or do a debt management plan, all will appear on your credit report for a period of time. However, continuously missing payments because you cannot afford to repay your debts is not helping your credit either.

How long will it stay on my credit report

- a first bankruptcy will remain on your credit report for years after you are discharged.

- a second bankruptcy will remain on your credit report for 14 years after discharge (and your first will re-appear and remain for 14 years as well).

- a consumer proposal will remain on your credit report a maximum of six years.

- a debt managment plan will remain on your credit report for a maximum of six years.

How to Correct Errors on Your Credit Report

When you receive a copy of your credit report, it’s really important that you make sure that the information it contains is an accurate reflection of your credit history. Your credit report will be used by lenders to determine whether... Read more » Read More

Do Credit Repair Companies Work?

If you have been through a bankruptcy or consumer proposal, you are very likely to want to improve your credit score as quickly as possible. You may even be considering paying a credit repair company, who offer tempting promises of... Read more » Read More

Understanding Your Credit Report

If you are thinking of borrowing money or applying for credit, your application will be assessed based on your credit report. But what exactly is a credit report and how is it used? It can be overwhelming to process all... Read more » Read More

How are Credit Scores Calculated?

Your credit score is one of the most important factors that you should consider when applying for credit. It is often the difference between being approved or denied credit, and it all boils down to three figures – which, in... Read more » Read More

How to Get a Free Credit Report

Your credit report is one of the main sources of information that lenders will use to determine how ‘credit-worthy’ you are. It’s therefore really important that you check yours at least once a year to make sure that it’s correct,... Read more » Read More

Bad Credit: What It Means and How to Deal With It

Whether it be a car loan, credit cards or a mortgage, debt is an increasingly normal fact of life for most Canadians. In 1980, the ratio of household debt to personal disposable income sat at 66%. By 2012, that ratio... Read more » Read More