Are you tired of living paycheque to paycheque and want to save money or pay down debt? Is better money management the solution for you? Read on to see how budgeting can help you achieve your money objectives.

Budgeting Is Simply a Better Money Plan

What you may struggle with is figuring out how to move from where your money is going today to putting your money to work for you the way you want. What you need is a money plan.

If at the end of every month you are scrambling to pay the rent, find it hard to pay off your credit card bills or struggle to set aside some money for your future, you have money problems.

Your budget needs to reflect your reality. You need to find ways to create more available cash flow to make ends meet. You need to balance your budget so you can stop using more credit every month and find a way to pay down your debt and start a savings plan.

That’s why we created this guide not just for budgeting but for Budgeting Your Way Out Of Money Problems.

Our 6 step budgeting process walks you through how to build a budget, specifically how to make a budget that will meet your financial goals.

Our budget process isn’t an app. There are way better budgeting apps out there and why build a better mousetrap? Sometimes doing things step by step with a spreadsheet is just better. The idea is to walk through a process of thinking, and planning, your way to better money management.

Oh, and by the way, it’s totally free. No email is needed either. Just download our excel budgeting spreadsheet and get budgeting.

What is Budgeting?

Budgeting is simply an estimate of your future income and expenses and a plan for where you want to spend your money.

We do more than talk about what budgeting is. Our guide gives you specific step-by-step instructions and an accompanying free budget worksheet to develop, implement, and maintain a budget that focuses on addressing your specific money troubles.

We’ll highlight instructions on what you need to input into your budgeting worksheets in green, each step along the way.

What’s different about our budget process?

There are a lot of websites that explain how to budget. However, budgeting when you are broke, living paycheque to paycheque, or carrying a lot of debt isn’t just about expense control. You need to find meaningful changes that can balance your budget. You need a way to know what changes you need to make to improve your finances. That’s what step-by-step budgeting with an excel spreadsheet accomplishes. Budgeting with an app is great once you know where you want to be; it’s not so great in helping you figure out how to get there.

Before we talk about budgeting, we need to talk about three fundamental principles to working your way out of any money problem:

- Be completely honest with yourself

- Make a plan and stick with It

- Be willing to make changes

Be honest about your money problems

Your budget needs to be based on an honest evaluation of your expenses, your debts, your goals, and your habits. To reduce spending, you need to understand what motivates you to spend, or even waste, money. You need to avoid those situations until you have stronger self-control. Ask yourself these honest questions:

- Are you a compulsive spender?

- Do you use shopping to deal with stress?

- Do you have access to too much credit?

- How many credit cards do you have?

- Are you careless about paying bills on time or watching what you spend?

- Do you plan or deal with money issues as they happen?

Make a plan and commit yourself

Set yourself up for success. Don’t look at budgeting as just a process of putting down some numbers on a piece of paper. Get the whole family involved in the process. If someone else gave you a budget to live by, you probably wouldn’t do it. The same goes for your family. Everyone needs to agree on what the priorities will be and how you will achieve them.

Make lifestyle changes

Whether you want to reduce debt or increase your savings, you are going to have to do something different from what you are doing today. There is no short-term easy fix. Like dieting, you will need to change your daily routine, your choices, and your habits. The key to meeting your budget, and achieving your financial goals, is to make small, lasting changes to your spending habits rather than making dramatic reductions one month that you can’t possibly maintain.

Better money management habits include:

- always pay bills on time

- use cash instead of credit

- limit credit card use to what you can pay off in full

- shop around, never pay full price,

- never buy on impulse

- shop less often,

- make a list and stick to it

- borrow items if you can rather than buying them

- become a DIYer (make your lunch or learn how to do basic repairs)

- THINK before you buy

Why Personal Budgeting is Important

A good budget does much more than limit spending. Budgeting is about learning how much money you have, where it goes, and finding ways to save and make better use of your money. When you properly create a budget, you benefit in a lot of ways.

A budget reveals problem spending patterns

A budget can act as a highlighter. It can provide some interesting revelations about where you are spending your money. You may not even realize where your money is going every month and why you always seem to be short on cash. By preparing a budget, you can find wasteful spending and make a plan to eliminate unnecessary expenditures.

It establishes priorities

You read a lot in budgeting books about understanding needs vs wants. While this might be a good discussion to have, sometimes it’s hard to see the difference. Budgets can reveal that you have too many priorities. It’s hard to pay down debt and save for a house at the same time. You need a little life balance in your budget. Budgeting helps put a timeline to your different goals and objectives.

Controls spending

Every day you make choices as to how you want to spend your money. Should you eat out today or brown bag it to the office? Should you purchase that new coat now since it’s on sale? Establishing priorities will help you make informed spending decisions that will keep you on track financially. It’s not about doing without; it’s about setting priorities and making choices.

Builds better spending habits

At first, keeping within your budget may be a struggle. You will need to identify what triggers your bad habits and replace bad habits with good ones like making shopping lists, cooking at home, using cash instead of credit, etc. Over time, these new habits will become part of your everyday spending routine.

Improves financial strength

Creating a budget and sticking to it can help you pay back debt, build better savings and improve your financial security. Once you get your spending under control, you can eliminate credit card debt, high-interest installment loans and other bad debt. Then you can focus on building up an emergency fund so you no longer have to rely on credit card debt when life throws you an unexpected curveball. Following a budget long-term can help you build a retirement fund or save for your children’s education. Whatever your financial goals, a budget helps you accomplish them.

Reduces stress

Worrying about financial matters is probably causing you to lose a lot of sleep. Having and following a plan to correct your money problems can be a stress reliever. A budget allows you to take back control over your money.

How to Create a Balanced Personal Budget in 6 Easy Steps

Creating a budget isn’t that difficult. People get frustrated budgeting because they try to put a fully balanced budget together without doing all the steps. Think of it like building a house. You don’t put the bricks on until you build the foundation and frame. The bricks might look nice, but they will quickly fall off if not supported by some structure. Your budget is like that.

If you follow a logical framework for creating your budget, you are more likely to achieve what you want. That framework includes understanding where you stand today, identifying where you can make changes, and setting a budget you can accomplish.

There is no right or wrong budget at the end of the day. Your budget will be unique to you. The only thing you need to be sure of is that at the end of the process, your budget will help you solve your money problems.

A SIMPLE SIX-STEP BUDGET CIRCLE

Budgeting is as easy as six simple steps. Taken one at a time, none of these is difficult. Follow each step along the way, and you will build a workable budget.

Our easy-to-use personal budget template will help in this process with step-by-step instructions and tabs.

Download our MoneyProblems Budgeting Worksheet and get started.

1. Identify Your Money Problem and Set Financial Goals

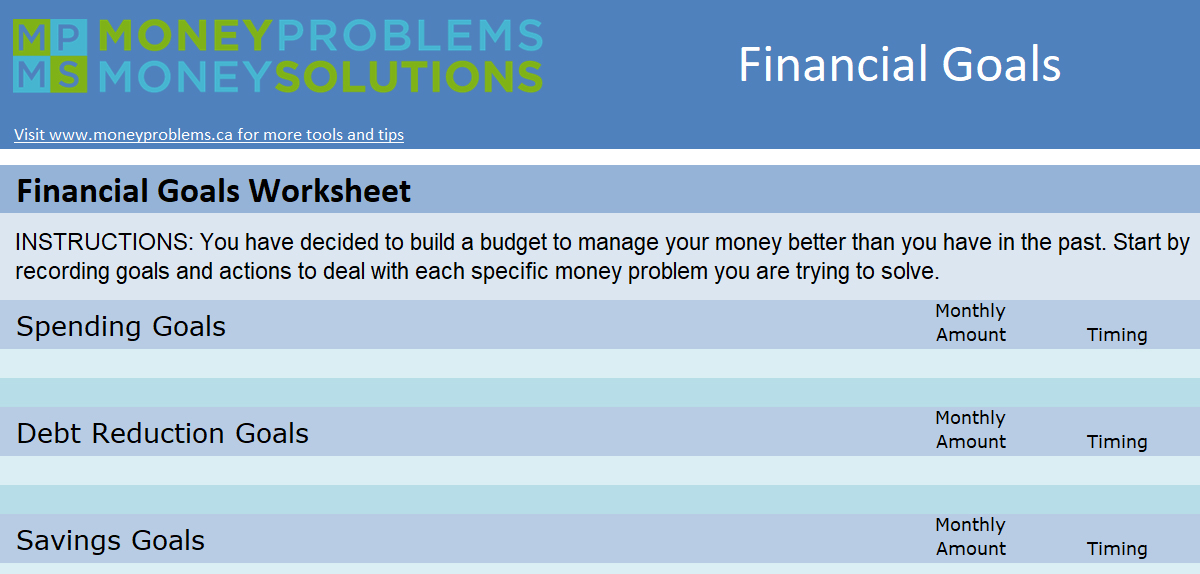

These decisions will be used to complete the Goals tab in your worksheet.

Budgeting is not hard, but it does take motivation, time and effort. If you are going to keep track of your expenses and look for ways to cut back on your spending, you need to know why you are doing this. Without a concrete goal, you will give up too easily or make excuses. Writing down what you want to accomplish is a powerful motivator. It can keep you on track when the road gets a little bumpy. Having no real purpose will ultimately lead to failure.

So you want to manage your money better. That’s a great idea, but money management is an activity; it’s not a goal. Why are you trying to make a change in the first place? You have to have a reason to budget. A good start is to look at the top three money problems a budget can help solve.

PROBLEM 1: I SPEND TOO MUCH

Unsurprisingly, this is the number one reason people choose to create a personal budget. While we all have expenses we can’t avoid like rent, food, or loan repayments, the truth is much of every person’s budget is discretionary. While it’s perfectly OK to have these expenses, they still need planning. You get to choose where you want to spend your money. What you don’t want is to keep running out of money before the next paycheque because you are not balancing your inflows with your outflows.

PROBLEM 2: I HAVE TOO MUCH DEBT

People often wait to budget until they are already in financial turmoil, which means making a budget for solving a crisis. Budgeting for debt reduction needs to cut back on expenses enough that you have positive, not negative cash flow every month and you must develop a workable debt repayment plan in your budget.

PROBLEM 3: I DON’T SAVE ENOUGH

It’s difficult to balance spending on what we want to enjoy today with saving for another day. Whether it’s building an emergency fund, putting money away for a better retirement, saving a downpayment for a home, or putting funds aside for your children’s education, having a balanced approach to saving and spending is important. Having a budget can help you prioritize and work towards that better balance.

Define your budgeting goals

Knowing that you have a money problem is a good start, but it’s not enough. You may tell yourself you need to spend less, save more, and pay off debt, but you need more concrete objectives.

The acronym SMART goals – specific, measurable, attainable, realistic, and timely – is a good one. The more specific your goals, the more likely you will remember them at crunch time – when you are tempted to stray from your budget. Goals also need to be tracked. You want to know whether or not you are succeeding.

Here are some examples:

- I want to pay off my $20,500 in credit card debt within three years.

- I want to save $3,000 by next winter for a trip to Mexico.

- I want to buy a home and need a down payment of $75,000.

- I want to put $500 a month into my RRSP.

Include both short-term and long-term goals. Break your goals down into smaller steps that are easier to accomplish. If you want to pay off your credit card debt in 3 years, make some supporting, smaller goals. I will pay $750 a month against my credit card debt.

Put these goals on the Goals tab in your worksheet.

Now that you know why you are budgeting, you can begin to build a personal budget that will help you achieve your goals. Stay positive; keep these goals in mind as you work through the process.

2. Record Your Current Bills and Expenses

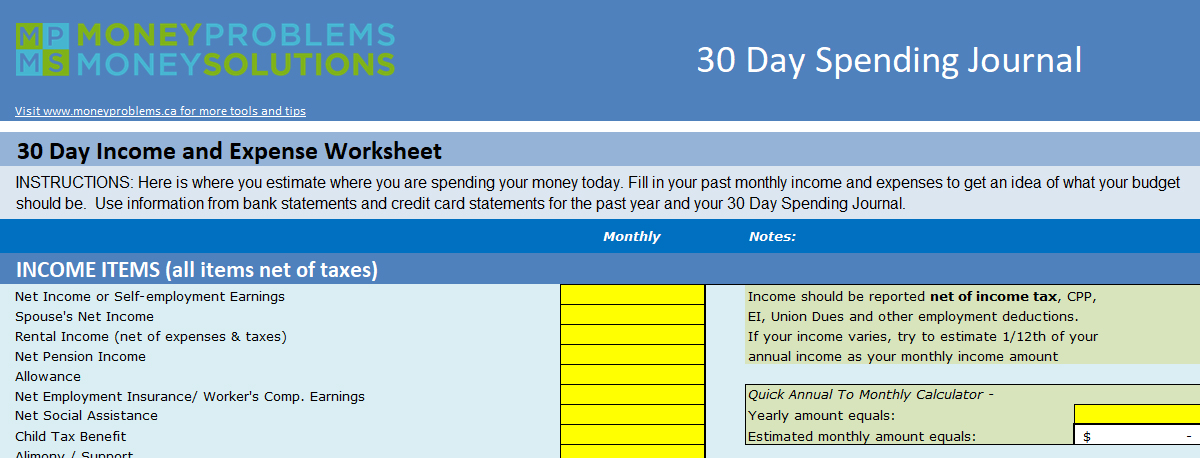

Use this information to complete the Current Spending tab in your worksheet.

Facts are the foundation of your budget. The budgeting process begins with knowing exactly how much money is coming in and where you are spending your money. Credit counsellors and budgeting advisors recommend you make a list of all of your expenses. Your list needs to be accurate. If you start with missing information, your budget won’t work. You will quickly find yourself overspending because you didn’t have a full picture of your expenses in the first place.

Gather past statements

Here’s what you will need to create your budget list:

- Income details from your T4 or income tax return

- Bank statements for the last year

- Copies of utility bills for the past six months if you have them

- Credit card statements for the last 3 to 6 months

- Other debt and loan statements for the last 3 to 6 months

Start by reviewing your bank statements for the past year to identify the larger expense items that you spend money on, like your rent or mortgage, car payments, utilities and insurance.

Keep a 30-day spending journal

Don’t know where you spend your money each month? To find out how much you are spending on all the items that are not on your monthly statements, we recommend you keep a 30-Day Spending Journal. Carry a small notebook with you, or use the notebook feature on your cell phone. Every time you make a purchase, mark it down. It’s important to include everything you spend money on, including coffee, lunch, magazines, parking, etc. If you use cash, write down the details. If you pay for a group of items with your debit or credit card, keep the receipts so you can allocate how you spent the money later.

Don’t forget to include debt repayments, automatic savings programs and other cash flow items in your list.

While you need to keep track of everything you spend money on, you don’t need to record every last detail. Lump expenses together, so they make sense but be honest. If you purchased a DVD at the grocery store, this should be entertainment, not groceries.

Examples of possible monthly expenses include:

- Mortgage or rent payments

- Food and groceries including eating out

- Property taxes and home maintenance

- Insurance costs

- Utilities, such as electricity, cable, phone, cell phone

- Medical expenses, such as prescriptions and equipment

- Child care and child support expenses

- Vehicle expenses including gas, car repairs, car lease or loan payments

- Clothing & personal care items

- Memberships

- Entertainment, recreation, vacation, and hobby expenses

Record your results

Now you can record your estimated monthly income and expenses in a Current Spending tab on your worksheet.

Everything you record here is what is happening now – how much money you make now and where you are spending your money today. Many budgeting books talk about jumping in right away to balance your budget. We will do that, but not yet. The first tab of our worksheet shows you where your money goes today so you can:

- learn from past mistakes and habits;

- identify areas you can improve.

We’ve separated our Income and Expense Worksheets into four broad cash flow categories:

- Income (inflows)

- Expenses (spending)

- Other debt repayments

- Savings

Notice how these line up with the three money problems we are trying to address with this book: overspending, paying off debt and not saving enough. By separating your outflows into these broad categories, you can focus on areas for improvement.

Recording your monthly income

Include all your income sources including your paycheque, pension income, support payments and any other sources of income you have (even money from Mom & Dad). All your income items should be recorded net of income tax, CPP, UIC, Union Dues, and other employee deductions. In other words, record your take-home pay because this is what you have to spend.

Include your full family income. Families should create a full household budget – not two independent budgets. Even if your debts are his & hers, it’s important to work together to meet all your financial goals.

Recording your monthly expenses

For annual items, you will need to include 1/12th of your estimated annual costs. For example, if you pay your car insurance once a year and the total cost is $1,200, then put $100 ($1,200 ÷ 12) in for one month.

Our MoneyProblems Budgeting Worksheet identifies expenses as F – Fixed and V – Variable to help you understand how you can manage different expenses.

FIXED VS VARIABLE EXPENSES

Some of your expenses are fixed, and some are variable. Fixed expenses are just that – fixed! They cannot be changed monthly and include items like your rent, mortgage payment, car payments, club memberships, monthly insurance payments, child care, and support payments. Scaling back on these expenses is possible but takes some long-term planning. Perhaps you need to find a smaller apartment or can cancel your club membership by giving appropriate notice. While you won’t find any quick fixes in this category, with a little planning, you can achieve bigger savings here.

Variable expenses are just like they sound; the amount you pay varies each month either with usage or based on your spending habits. Variable expenses, including things like food, utilities, cell phone bills, entertainment, clothing, personal items, etc. Here is where you will be able to find easier ways to cut back on spending. Perhaps you can eat in more often, take a pre-made lunch from home. Take a look at your cell phone and utility charges – can you find ways to reduce these by making small changes in your daily habits like cutting back on long-distance or looking for ways to reduce your hydro usage?

We have also allocated your living expenses on our Budget Worksheet between Discretionary and Non-discretionary.

DISCRETIONARY VS NON-DISCRETIONARY EXPENSES

Now we are going to take the same expenses and look at them differently. Non-discretionary expenses, like rent, loan payments, and insurance, are items you can’t avoid, although, with long-term planning, you can reduce even these types of expenses.

Discretionary expenses are items that, strictly speaking, are not necessary. You can choose not to incur these expenses. Discretionary expenses include items like entertainment, club memberships, vacations, and that extra pair of shoes you wanted to purchase this week. These are the expenses that provide the most obvious and quickest way to reduce spending.

You may note that we treated food as a discretionary expense. A portion of these expenses can be both discretionary (i.e., controllable by you) and non-discretionary. For example, while food is a non-discretionary expense (we have to eat after all) how you choose to spend (eating in or going to a restaurant three days a week) can be discretionary. Your phone bill may or may not be discretionary (having a landline when you have a cell phone, for example), and some of the services may be optional. You may find some quick-fix savings here as well.

Don’t worry yet if your expenses are more than your income. If you’re having money problems, it’s better to know how much more you spend than you earn. That’s why you’re making a budget. The next steps will help you bring your budget into balance in a thoughtful way.

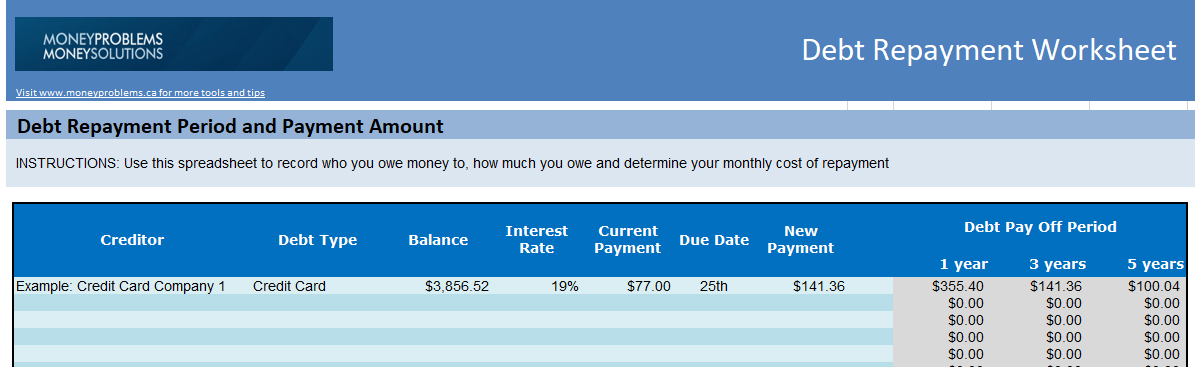

Record debt payments and savings

Make a list of all your debts, including who you owe, your balance, and the current monthly payment on the Debt Repayment Worksheet tab. Exclude your mortgage; this should have been included in your housing expenses.

Transfer the total monthly payments to the Other Debt Repayment Section in the Current Spending Tab.

If you are currently only making the minimum payment on your credit cards, record the minimum payment amount from your last statement.

Be sure to include all loans on your list. If you borrowed from friends or family and haven’t started repaying that debt yet, include it on your list with a current debt repayment of zero.

Record your monthly savings plan in the Savings section.

If you have an automatic savings program through your employer, like automatic RRSP savings, include the amount taken from your paycheque as income AND as savings. It’s important to track your savings separately. You don’t want your income understated or savings excluded from your worksheet.

If you aren’t saving anything right now, be honest about that too and put zero.

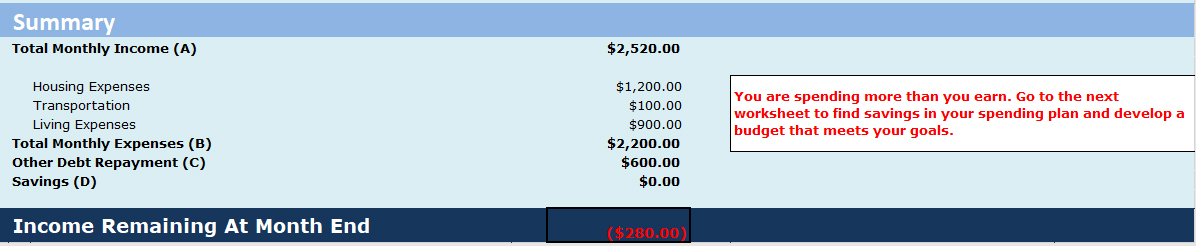

PULLING IT ALL TOGETHER

The last step is to put everything you’ve recorded in one short summary.

Our worksheet will automatically carry your total monthly income, expenses, debt repayment, and savings amounts into a simple summary at the bottom of the worksheet. This will tell you how you are spending your money today.

You may, once you add it all up, find you are spending more than you make. If you continue with this course, you will continue to add to your debt and won’t have any savings for the future.

The good news is that you are going to fix that. Now it’s time to start planning your future. Next on your list – take a cold hard look at where you can cut back and how you can achieve your goals.

3. Analyze Your Expenses

It’s time to find the weak points, look for ways to save money, and reduce costs.

You’ve kept a 30 Day Budget Journal and have a worksheet with all of your current income and expenses organized into categories. Now it’s time to look through this tab and analyze your expenses to find ways to reduce your spending and control your budget.

Target expenses for savings

A budget can indeed be as simple as depositing your paycheque, paying your bills, and spending what’s left. But if you want to improve your overall money management, you need to dig deeper, finding ways to save money so you can meet the goals you set.

- Start with the easiest costs to reduce – your discretionary, variable expenses. You can choose to rent a movie at home rather than go out. Similarly, you can postpone that big vacation until you can afford to pay for it ahead of time.

- Next, look at your discretionary fixed expenses. You may need to cancel that club membership for a while. Similarly, you may want to review your cell phone and cable bill. Are there additional services you are paying for that you can do without? These savings take planning. You need to provide appropriate notice under the terms of any agreement you signed.

- Even variable non-discretionary items provide opportunities for savings. Review your personal habits to see if you can reduce these costs. Can you turn down your air conditioner or hot water heater? Do you turn off all lights and equipment when not in use? Can you save money by brown-bagging it for lunch or eating out less? You may be able to save money by switching brands where possible for personal care items and shopping around for savings on maintenance costs.

- Non-discretionary fixed expenses are the hardest to tackle but could provide the biggest rewards. Saving here means thinking about your lifestyle choices. Is your home more than you can afford? Can you reduce your loan payment costs by qualifying for a lower-interest debt consolidation loan?

Look at Your Spending Ratios

When creating a personal budget, how do you know if you are spending your money wisely or not? How much is too much for different expense categories? While every household is different (you may have kids while someone else lives alone), credit counsellors and financial advisors often use specific spending ratios to analyze living expenses, housing, and transportation costs.

A spending ratio is simply the amount of money you spend in a particular category as a percentage of your overall budget. You can monitor your ratios, and if you are spending a little too much in one area, plan to cut back.

Our worksheet will calculate what your spending ratios are on the Your Budget tab.

HOUSING COSTS

One of the largest expense areas you will have will relate to housing expenses. Housing costs include your rent, mortgage payments, property taxes, repairs and maintenance costs, and utilities such as hydro, gas, water and telephone services. You may want to include cable and internet if you consider these a necessity, or you can consider them to be a discretionary items that you can cancel to save money if needed. In general, most financial advisors recommend that your housing costs make up no more than 35% of your overall budget.

If your housing costs are more than 35 percent of your budget, you’re paying too much for housing and should look for ways to cut your costs.

TRANSPORTATION COSTS

The second-highest expense in your budget is likely transportation costs, including money spent on public transportation as well as a car loan or lease payment, gas costs, car insurance, maintenance, and repairs. If applicable, you should also include parking fees.

The average Canadian spends approximately 20% of their budget on transportation-related costs. If your costs exceed this amount significantly, you should review your expenses for possible savings.

LIVING EXPENSES

Living expenses include food, clothing, entertainment, medical costs, and other personal expenses.

Your total remaining living expenses should be less than 20% of your budget.

OTHER DEBT

Excluding your mortgage and car loan costs, your other debt repayment costs should average no more than 15% of your total budget. Include payments for credit card debt, personal loans, student loans, and any unsecured debts.

A word of caution here. If you meet this ratio by considering only the minimum payment on your credit card debt, you are still spending too much on debt repayment.

If you are dealing with too much debt, and that is why you are looking to create a budget, your ratio is probably too high today. Your goal will be to reduce this ratio over time by paying down debt. Budgeting for a high ratio to pay off debt sooner is fine. Having a high ratio because you are taking on more debt is not.

SAVINGS

It is important that, once your debts are under control, you manage to save money for the future. If your debts are under control, then savings should account for at least 10% of your overall budget. If you owe too much on high-cost unsecured debts, this amount should be applied towards debt repayment first, then long-term savings.

These ratios are guidelines you can use to assess whether or not you are spending a little too much in one area. They can help you find areas where you may need to reduce spending so you can build a well-balanced budget that meets your personal goals.

4. Balance Your Personal Budget

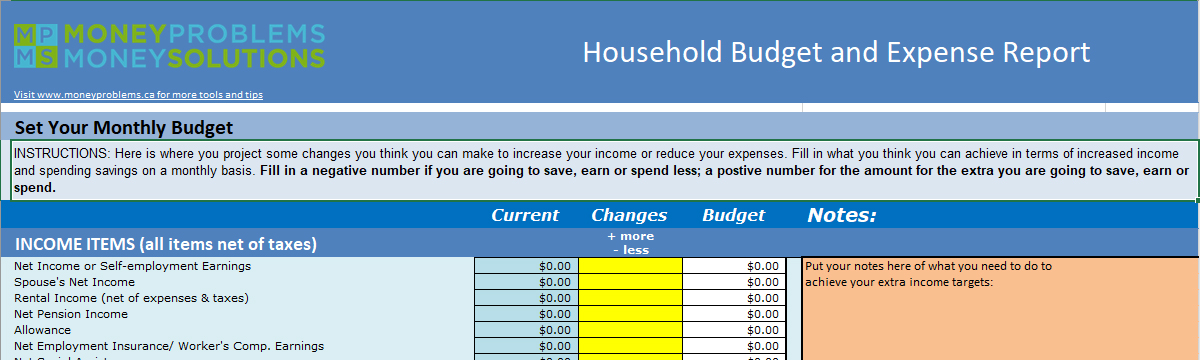

Move on to the tab labelled Your Budget on your worksheet and use the middle column to record changes (savings and extra income you found in step 3) that will balance your budget.

A budget tells us what we can’t afford, but it doesn’t keep us from buying it. – William Feather

Finally – you are ready to build your own Personal Household Budget. You know where you were spending your money before, you’ve looked at your expenses and found some areas that you can cut back on. Perhaps you even found ways to increase your income. Now it’s time to put it all together.

Here is your task:

INCOME – SPENDING – DEBT REPAYMENT – SAVINGS = $0

This formula is the basis of zero-based budgeting. You are working to balance your budget to zero. That doesn’t mean you spend everything you make; it means you allocate every dollar you make to some purpose. So if you take home $2,000, you are going to allocate a total of $2,000 to spending, debt repayment, and savings. If you want to pay off your debt sooner, you need to spend less. Once you are in better shape, you can allocate more to savings.

Decide where you are going to make changes. Fill in where you plan to cut back, earn more, save more and make higher debt repayments. By building your budget as a series of changes from your current spending patterns, you will identify action plans that you need to take to achieve your goals. Things like:

- Eat out no more than once a month – savings $300 a month

- Cancel gym membership – savings $100 a month

- Change cell phone plan – savings $35 a month

- Limit entertainment budget to $100 a month – savings $250 a month

By identifying clear, concise actions that you can take and by putting a dollar value against these actions, you are more likely to stick to your intentions. If you choose to eat out more than you planned, you will know what the cost to your budget goals will be.

5. Track and Manage Your Budget

Budgets need to be managed. That means keeping track of your recurring monthly bills and expenses and looking back to see what’s working and what’s not.

Track your spending

You can track your spending manually on the Tracking tab of our excel budget spreadsheet (make a copy of the tab for every month) or use an online budgeting app. Use your favourite budgeting system for managing your day-to-day spending.

![]()

Either way, unless you track your actual results, you will have no way of knowing:

- If your budget is realistic;

- If you are working within your budget; and

- If you are going to be successful in achieving your goals.

Set some time aside, once a week, to update your budget and record your spending. Just like you did when you completed your initial 30-day spending plan, keep receipts and write things down in a notebook or on your cell phone as they happen. If you wait until the end of the month, you will more than likely have forgotten where your money went.

Here are some tips that can help you stay on budget:

Avoid temptation. If you are an impulse shopper, leave your credit cards at home. It’s hard to blow your budget if you limit how much cash you carry and don’t have access to credit.

Use the envelope system. Take out what you budgeted for daily living expenses on payday and allocate the cash into different envelopes for groceries, personal items, entertainment, etc. Once an envelope is empty, stop spending.

Don’t count on windfalls. If your income varies, estimate on the low side. Don’t count on bonuses, tax refunds and other unreliable sources of cash flow. If you earn extra, make a conscious effort to apply that amount directly towards your goals (debt repayment or savings), not towards extra spending.

If you do find you overspent one month, don’t give up. Sometimes things come up (an unexpected invitation to your co-worker’s birthday), and sometimes you will spend more than you should. If that happens, see if you can catch up next month. If you can’t, do not get discouraged. Just get back on track immediately.

6. Revisit, Revise & Adjust

Creating a proper budget upfront will reduce the risk of failure.

A good budget, one that you will stick with, should never be cast in stone. Life changes as do your priorities. You need to make adjustments to deal with the unexpected. Maybe you would rather eat out this weekend than purchase that outfit that was in your clothing budget. Perhaps your neighbour just invited you to his son’s wedding.

Budgeting in a circle allows you to revisit your goals and priorities. One of the main reasons why budgets fail is that we don’t allow for this flexibility.

It’s very important to review your budget regularly. Adjust your budget categories up or down as needed, but always keep your main financial goals in mind when doing so. Revisit your habits and make small changes.

If you do the work to create a good budget upfront, then commit to learning from your mistakes and making necessary adjustments along the way, you will soon find yourself able to balance your budget and work your way out of your money problems.

Start Your Budget With a 30-Day Spending Journal

The best budgets are a realistic and accurate representation of your personal finances. That means you need to plan your budget around a reasonably complete picture of what you earn and where you spend your money. If you budget to... Read more » Read More

Needs Vs Wants: Tips to Create a Budget with Room for Both

If the reality you are facing is a budget that is stretched too thin, the next obvious step is to look for spending you can eliminate. That being said, it’s no fun to go through life only buying things you... Read more » Read More

Which Budgeting System is Right for You?

Budgets need to be managed. That means keeping track of your spending on a fairly regular basis. Without some form of monitoring, you will have no way of knowing: If your budget is realistic; if you are working within your... Read more » Read More

Why Budgets Fail

We’ll let you in on a little secret, most people have a really hard time executing their budgets. The reality is that we are all only human, and sticking to budget isn’t easy. That being said, there are some simple... Read more » Read More

Zero based budgeting: What it is and why you should be doing it

What is zero-based budgeting? Zero-based budgeting means that every dollar of income you have coming in must be accounted for in your budget. Every dollar is given a purpose by being allocated to specific expenses, savings or debt repayment. A... Read more » Read More

Budgeting for Manageable Debt Reduction

Debt is a normal fact of life for most Canadians. But if you’re in a cycle of dwindling savings and increased debt levels, it’s time to regain control of your finances. Finding money for debt reduction can seem like an... Read more » Read More